Greetings!

This Signal’s images are from my brief sojourn in the lowlands, the aggressive green of spring, fantastic. The dogs and I are back in the mountains, veins open as the saying goes, variously attributed, but basic idea is that writing is like bleeding, with a suggestion of suicide. (Don’t worry.) I hope to have a few publishing announcements very soon – watch this space! Meanwhile the aspen buds are bursting, will leaf out any day now.

A little housekeeping, not to be confused with begging. My “engagement” is rather low, in part because many of you know me and write directly, which is great. But, everybody, please engage: like, write a comment, restack the post, or forward to a friend. Substack is from California; they love that kind of stuff. Seriously, the platform promotes my work to people who might not otherwise see it. I care, not just because of Intermittent Signal, but because I want to use this newsletter to support books, and for that I need numbers.

I try to restrict Intermittent Signal to things I’ve not read elsewhere, and therefore have been quiet on the upcoming Presidential election. I have any number of fairly ordinary things to say, but you’ve probably seen them already. So many monkeys, so many typewriters, I’m waiting for Hamlet.

The following argument, however, seems to me new (or at least rare, almost as good), and might be of interest. The basic observations come from my wife, who told me, in not quite so many words, that neither Paul Krugman nor I had any idea of what household spending actually looks like. She has a point: like the King, I have a purse bearer. Money for me is mostly a field of thought, something to teach. So, I started thinking, and talking to people, about household spending and political sentiment.

Inflation, Debt, and Political Sentiment

The Biden administration has made much noise about inflation rates not rising, or rising relatively slowly. For these purposes, the inflation rate is generally measured monthly, and compared to the rate of the preceding year, i.e., the Biden administration thinks it has done pretty well at bringing inflation down. (The Fed is less convinced.) Plus, unemployment rates are very low, and wages, especially at the lower end, are up. Nonetheless, poll after poll shows Biden losing to Trump on the economy, with people citing inflation. It’s mystifying! Cheerleader Paul Krugman frequently bemoans the fact that the electorate just does not get the numbers.

Let me dispose of a few obvious problems up front. First, thinking about inflation in terms of expectations, sentiment, and then talking down to those who hold such sentiments, really? Stupid proles, don’t they recognize what we have done for them? It’s a bit primitive, and unlikely to win political points. Sort of like telling people how to talk, which has been a real winner for “progressives.” More ontologically, inflation is about expectations, sentiment, and therefore much of central banking practice is communicative. See my buddy Douglas Holmes, Economy of Words: Communicative Imperatives in Central Banks.

Second, nobody remembers year on year deltas, or even month to month. Anyway, I don’t. People remember what a carton of eggs, a gallon of gas, or a drive-through meal at McDonalds recently used to cost. So, the Dems suffer for last year’s jump in prices, even if inflation, as measured now, is down. Dead flat wouldn’t solve that problem until people come to accept the new, higher, normal, which means they will be able to buy less. Even absent other misfortune, such folks just might feel immiserated, and not want to vote for the government that they see as responsible, indeed, that claims to be responsible. Shocking.

[As an aside for some of you, and you know who you are: I’m bracketing questions about what “inflation” really means; for now, let’s just consider nominal price changes. Item used to cost $X, now costs $2X = 100% inflation.]

Third, much of the discontent with the economy, for which “inflation” is a shorthand, seems to be a concern for medium to long term prospects, for kids and otherwise. Everything is going to hell, which is a major theme for the Dems. Maybe true, but puts a real damper on animal sentiments. Having a Democratic Party that doubles down, in fine progressive fashion, on everything that sucks might be spiritually satisfying for some, but is unlikely to improve consumer sentiment. And so, when asked about their discontents, people often say “the economy,” and more specifically, “inflation.” A few years ago, when inflation was quite low and had been for ages, my students invariably complained about the economy, student debt, tight job markets, whatever in terms of “inflation.” They don’t actually mean inflation. Without sounding too whiny, they are trying to express their feeling that it’s getting harder to see a way forward. In many cases, they are not wrong.

Those things said, and for present purposes dismissed, let me consider the possibility that the people who say they are feeling squeezed just might be telling the truth.

In an effort to fight inflation, which hurts lower, middle, and even upper middleclass folks, the Fed has raised interest rates. Fair enough, certainly the usually prescribed medicine. But at the same time, most working to upper middleclass Americans hold adjustable interest rate debt, on real estate, car loans, private student loans (most loans are federal, and the interest rate is fixed), and credit cards, tied to those same rates that the Fed raised. So, the cash flow of many people is directly constricted by the anti-inflationary policies designed, ultimately, to curb inflation on the goods and services such people buy. Thus, the gain from a higher wage, or the flattening of goods and services costs, might be more than cancelled out by a higher debt burden. More subtly, while inflation may be “sticky,” interest rate changes on many types of debt are fairly immediate. In short, households may feel themselves worse off for the simple reason that they simply have less to spend. The political implications for the Dems are obvious.

Moving up the totem pole slightly: a number of widely discussed factors have led to increases in real estate prices. In addition, localities seem to be taxing property much more heavily, both by reassessing market value of properties and by raising millage rates. In my home in Colorado, the increase has been roughly 100%. My situation in Kansas is similar, if not quite as dramatic. I asked my local grocer if the rate changes were just in my neighborhood. Staff got involved; everybody’s bill had gone up; there was a lot of anger. The grocer tells me she cannot pay people enough to live there. Locals are being priced out. Perhaps, from the perspective of state and local governments, such tax increases are justifiable, maybe on account of increased labor costs for civil servants in a tight employment market. Be such things as they may, in many places the average homeowner is paying a lot more, monthly, in taxes. Add to the floating interest rate problem noted above, and the stress on households – except for really wealthy households – can be considerable.

My point is that, for many folks, free cash flow has declined of late, even if the notional balance sheet of people like me has done just fine, thank you for your concern. But, even for the affluent, real estate and retirement funds are not the household budget. Income statements are not balance sheets, which may sound obvious but has profound consequences. So, we are seeing changes in how folks look at their spending.

For example, my buddy George owns a string of pizza joints, good small town American pizza, nothing too fancy. He tells me that a lot of his regular customers used to order a pizza when in a hurry, too tired to cook, and so forth. Now, for these people, getting a pizza is special, a restaurant meal, not a convenience. That’s a change. There are more important problems, of course, but it’s a tangible comedown for the working families that surprisingly seem to be fleeing the Dems.

And my students, graduating and becoming lawyers, are annoyed because they cannot afford a new car. Car prices are amazingly high, and so are the interest rates on car loans. So, they drive clunkers, and if somebody asks if they feel they are better off, etc., my guess is half of them will complain about inflation.

I’m not aware of official efforts, by central banks or others, to aggregate changes in the cost of household debt service and taxes with changes in the cost of goods and services. What I have in mind is something like “real feel” weather numbers, because wind and humidity matter to how actual humans (as opposed to thermometers) respond to heat. Such a number must be difficult to generate well. One can, with effort, come up with a relatively representative basket of goods and services in an area, and assume that lots of people across classes have to eat, etc. But debt and tax situations vary wildly across individuals, and across social class.

But just because something is hard or even impossible to measure does not mean it isn’t there. For now, political discourse is blinkered by looking at changes on the price of a basket of goods, declaring that to be indicative of “household welfare,” and then expecting voter sentiment to fall in line.

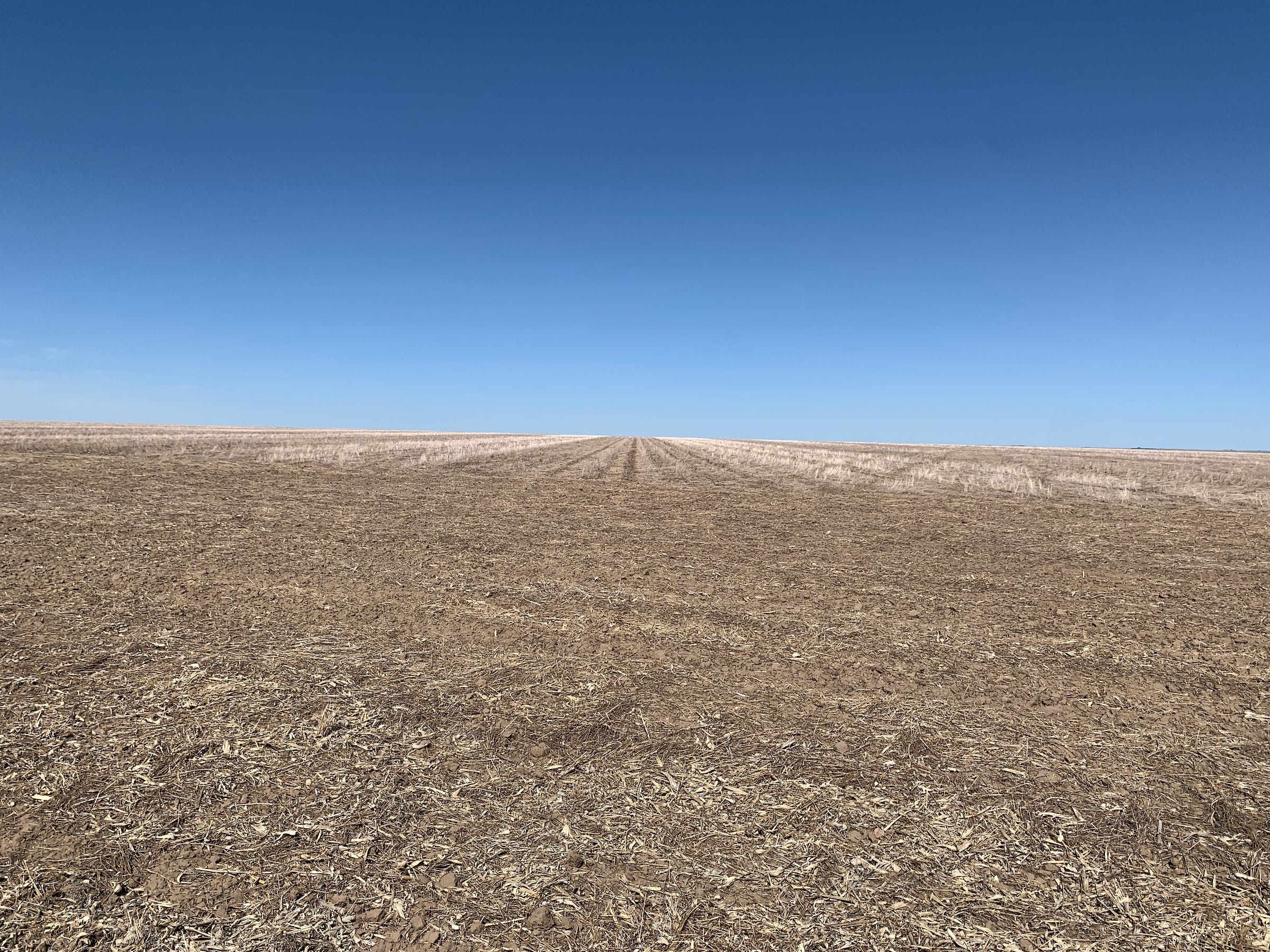

Windmills. One of my many blessings is the frequent chance to drive across the Great Plains, at all times of year. Simply fantastic – the skies, the colors, the horizontals, the loneliness, the speed. On recent trips, the grasses are greening up, the fields are in various stages of plowing. Oil prices are up and the nodding donkeys are all nodding, but at the same time, the energy transition is in full swing. Windmills are everywhere, and that is quite new, and more are going up it seems daily. Trucks are built with I-beams, no chassis, to create a vehicle long enough to carry a single blade. Now that the winter is passed, the trucks, with their escort vehicles, are out, hauling their giant wings to windswept sites. There is a lot of wind out here, and land is not particularly expensive. A town in eastern Colorado is giving land away, with water, a sign says. I get it. And I’m supportive of wind power, in principle and for obvious reasons, but a lot of high plains lonesome has been somewhat industrialized, visible for so many miles.

Such musings aside, I’m enraptured by the windmills themselves, especially the blades, everything both straight and curved, like a Grecian column. But these objects are hyper modern, huge, sleek. This is modern at its best. Up close, especially, I think of planes and boats, not womanly or even organic, but somehow feminine nonetheless. Ok, I’ve been on the road a long time.

Yeah, me and Caspar David Friedrich.

Safe travels.

— David A. Westbrook

you triangulate -- Colo -Ks -upstate NY? Nice essay. So we get the structure of feeling about things mislabeled (or not) "inflation", "economy sucks", etc., but what do we do about it so that the would-be fascist and the apartheid court don't win in November? Any help from Doug? (ps George now is into pizza joints? just kidding, Caspar David Friedrich)

Go back three years and the economic consensus was that the US would be in a recession at this point. Prices would be fine because there would be high unemployment and thus people would not have money to spend. Pouring in money and luck traded the recession for moderate inflation in general and significant inflation in a few sectors, such as housing.

It is understandable that many people are unhappy with the current economy as they remember the pre-pandemic low interest rate, low inflation, low unemployment work. Everyone would like that world back. But I suspect that most of the folks most aggrieved by today's economy would choose it over a low interest, low inflation world where they are unemployed. But Biden gets no credit for avoiding that world because it didn't happen and thus is not on the average citizen's horizon,

Unfortunately, none of the media, including the mainstream media spends much time on the alternative world that we managed to avoid. Nor do they talk about the alternative world Trump would likely bring by extending the 2017 tax cuts without offsetting spending in a high interest world.